Title Loans vs. Payday Loans: Which Is Better for You?

- ahenz7797

- Jun 4, 2025

- 3 min read

In times of financial stress, fast access to cash can be a lifesaver. For many people facing urgent expenses, such as medical bills, car repairs, or late rent payments, short-term loans offer a temporary solution. Two common options are title loans and payday loans. While both provide quick access to cash, they operate very differently and come with their risks and benefits. Understanding the key differences between these loan types can help you make a more informed decision.

Understanding Title Loans

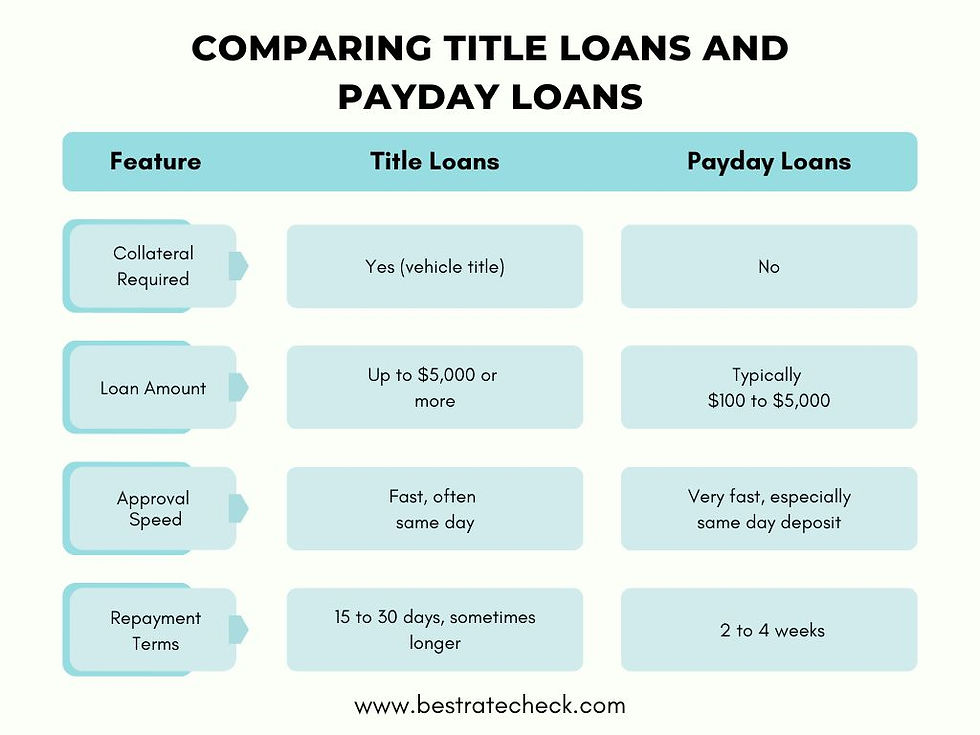

It is a secured loan where you use your vehicle title as collateral. Title loans are typically available to borrowers who own their car outright or have significant equity in the vehicle. The lender holds your vehicle title and gives you a loan amount based on a percentage of your car’s current market value—usually 25% to 50%.

Key Features:

Collateral Required: You must own your car or have enough equity in it.

Loan Amounts: These can be higher than sometimes up to $5,000 depending on your car's value.

Repayment Terms: Usually 15 to 30 days, though some lenders may offer longer terms.

Repossession Risk: Your car may be repossessed by the lender if you are unable to make payments.

It can be helpful if you need a larger amount of money and own a vehicle. However, the risk of losing your transportation should not be underestimated. Only taking out loans that you can afford to pay back is crucial.

Understanding Payday Loans

These are high-interest, short-term loans meant to keep you afloat until your next payday. Since there is no collateral needed for these loans, they are unsecured. They are known for fast approvals and quick access to cash—especially payday loans online same-day deposit, which can deliver funds to your bank account within hours.

Key Features:

No Collateral Needed: Based on proof of income and a checking account.

Loan Amounts: Typically range from $100 to $5,000.

Repayment Terms: Usually due on your next payday, generally 2 to 4 weeks.

Same-Day Access: Many lenders offer online same-day deposits, ideal for emergencies.

They are best suited for smaller, short-term financial needs. They can be lifesaving for urgent bills or unexpected expenses, but borrowers should be cautious of high APRs and short repayment windows.

When to Choose a Title Loan?

A title loan might be a better option if:

You need a larger sum of money quickly.

You own your car outright or have a high-equity vehicle.

You have faith that you will be able to pay back the loan on schedule.

Keep in mind, that the biggest risk is losing your vehicle. If you rely on your car for work or daily responsibilities, this could lead to bigger issues than the financial emergency itself.

When to Choose a Payday Loan?

Payday loans online deposits are ideal if:

You need a small amount of cash urgently.

You don’t have collateral or own a car.

You want to avoid a credit check.

These loans work well for covering immediate expenses like utility bills, minor car repairs, or grocery costs. However, be sure to budget carefully and repay the loan on time to avoid high fees and rollover penalties.

The Dangers of Relying on Short-Term Loans

While both loans can be useful in emergencies, they are not long-term financial solutions. High interest rates and fees can quickly turn a small loan into a large debt if not managed properly. Many borrowers fall into a cycle of renewing or “rolling over” loans, leading to repeated borrowing and growing debt.

Before choosing either loan:

Explore all alternatives like borrowing from friends or family, local community resources, or negotiating with creditors.

Utilize loan calculators to determine the actual cost of borrowing money.

Borrow no more than you can pay back in full and on schedule.

Safer Alternatives to Consider

Some alternatives may offer lower interest rates and more manageable terms:

Installment Loans: These loans provide a lump sum with a longer repayment period, typically in monthly installments.

Credit Union Loans: Members often receive better rates and more flexible terms.

Emergency Assistance Programs: Many communities have programs that offer help with rent, utilities, or food during crises.

If you do decide on a payday loan, consider using reputable lenders that offer payday loans online with same-day deposits with transparent terms and no hidden fees. At Best Rate Check, we make it easy to compare trusted lenders and find the best loan option for your needs.

Conclusion

Choosing between a title loan and a payday loan depends on your financial situation, the amount you need, and your ability to repay. Both can provide fast cash when you need it most, but each comes with its own set of risks. By understanding how each loan works—and by comparing offers on Best Rate Check—you can make a decision that supports your financial health rather than jeopardizing it.

Visit for more information:- Is a Title Loan Safe? What You Should Know Before You Apply

Comments